News

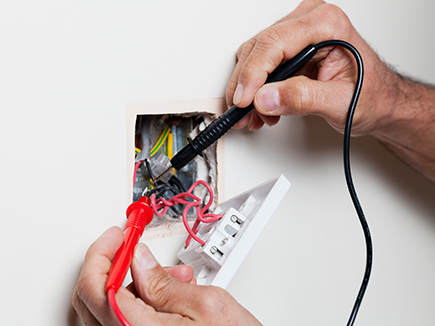

Electrical Safety Standards: are you ready for April 1?

From April 1 all existing specified private tenancies will need to comply with the new Electrical Safety Standards in the Private Rented Sector (England) Regulations 2020. The regulations were first introduced in June 2020 to new tenancies and are being rolled out to cover most lettings....

How will the government's commitment to cut emissions affect landlords?

The Government’s advisory Committee on Climate Change has called for the UK to cut its emissions by 78% by 2035 in a bid to reach a "net zero" pollution goal by 2050. That leaves just 30 years to reduce almost all emissions to zero (any remaining pollution is to be offset by measures to absorb carbon such as planting trees) and with UK households contributing 40% of emissions, it is inevitable that landlords and other homeowners will be impacted by these changes....

Demand in homes with a garden surges after lockdown

There has been a significant rise in demand for homes with gardens from tenants and buyers since the housing market re-opened in May following lockdown, according to the latest figures. Fears of a second wave are reportedly fuelling a growing appetite for properties with an outdoor space research from property rental app Movebubble suggests, with searches rising 193% compared to the week before lockdown....